Traditionally, asset management and investment were reserved for business magnates and career investors operating in business districts across the globe.

The current asset management landscape, however, is much different than this.

The rise of the internet age and the subsequent increase in information accessibility has introduced a new breed of investors, and investment assets such as digital currencies and NFTs, to the industry.

All these developments have made the environment more lucrative for newer investors.

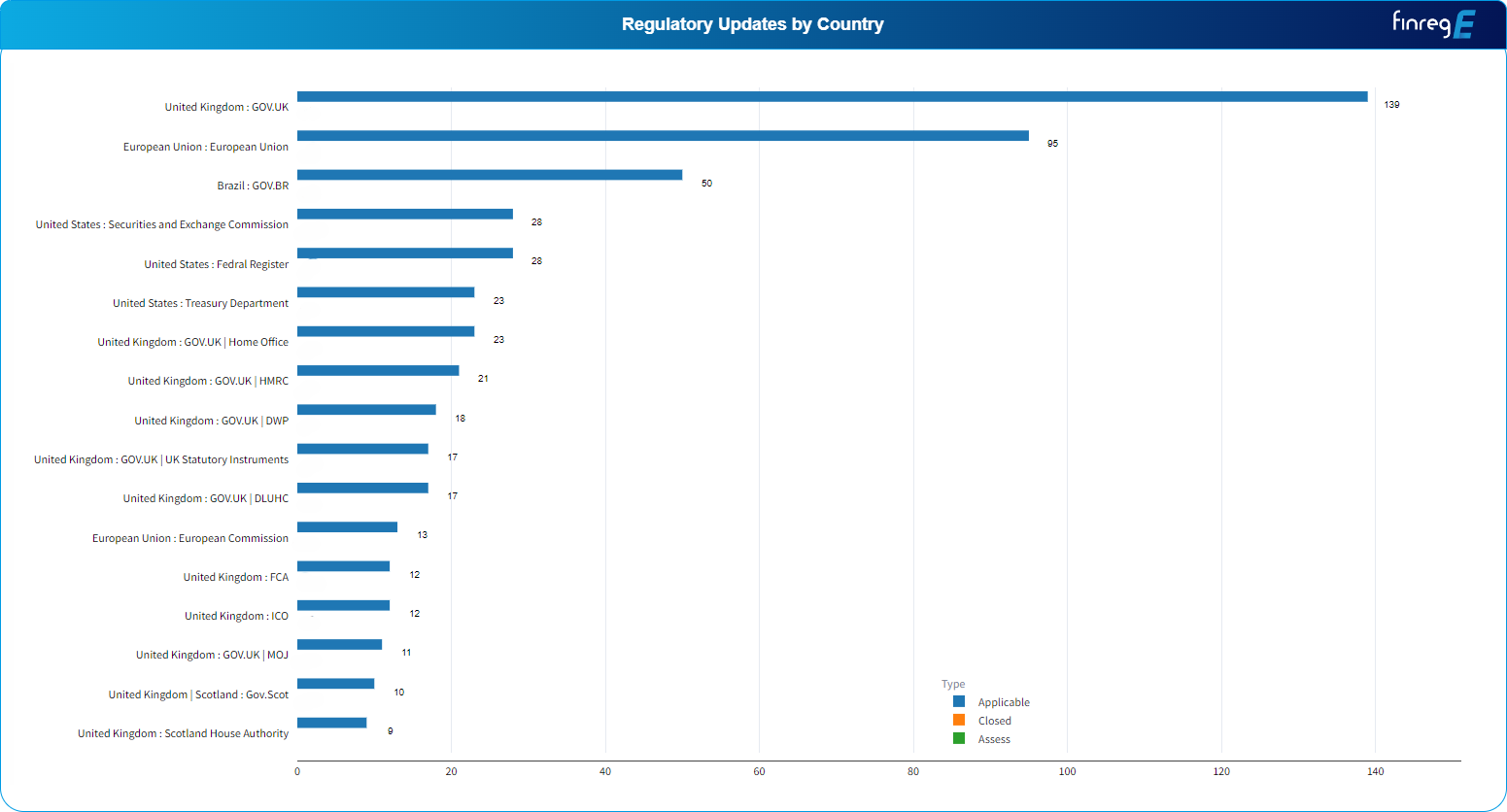

Another trend in the industry is the rise of pan-regional investment management companies. Today, four regional fund distribution and management blocks have formed in North Asia, South Asia, Latin America, and Europe.

To become successful in this landscape, asset management firms have adopted new strategies and technologies, such as automated investment analytics and fixed asset management software.

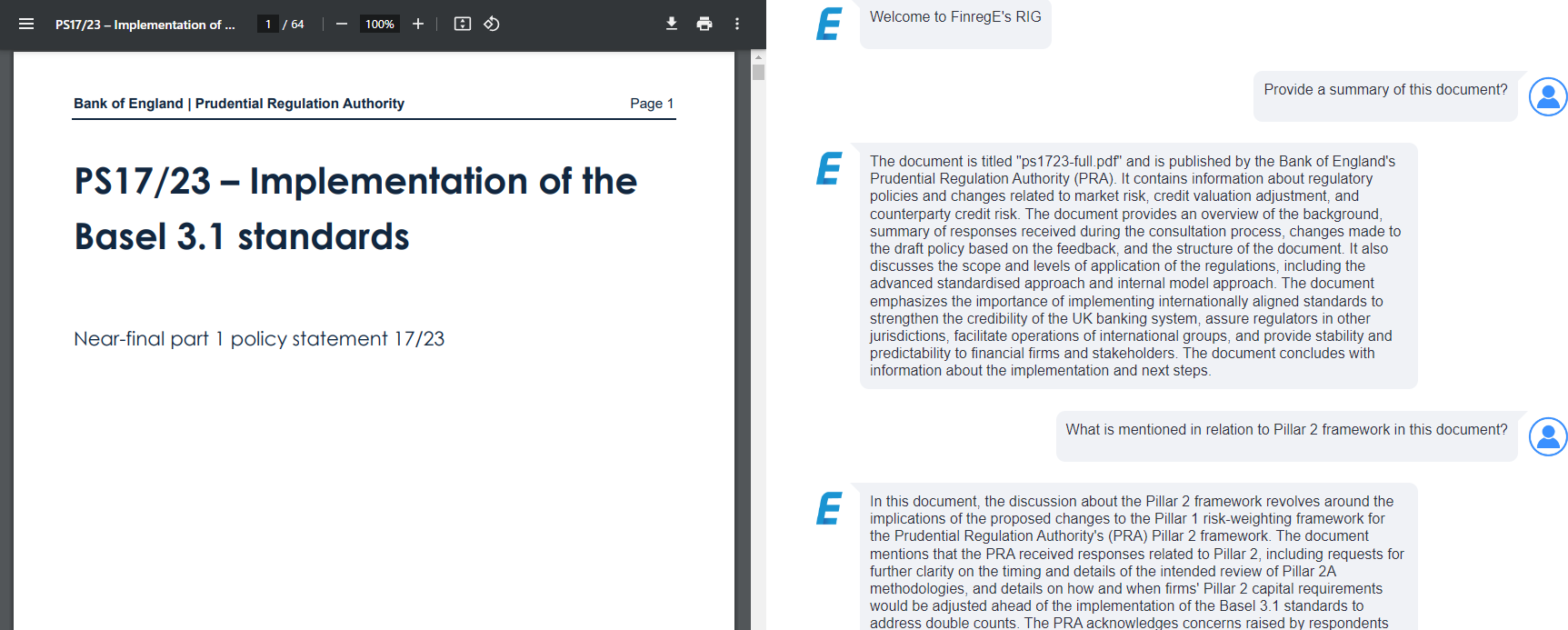

Despite their best efforts, however, asset management companies are now under more pressure than ever before. Advancements in the investment industry and subsequent steps taken by regulators to enforce policies have made the compliance landscape more complex.

Monitoring compliance is key to navigating this complex environment effectively.

In this post, we look at why monitoring compliance is more critical than ever for asset management firms.

The differences across regional regulations

The rise of pan-regional asset management companies means that investment managers from these companies work with investors from several countries.

Regulations governing investments will vary across these countries, and investment managers need to know about these regulations to ensure compliance.

In Europe, for example, investment regulations are stringent and require complete transparency regarding the investments of individual investors. In the USA, on the other hand, policies governing the disclosure of investments are more relaxed.

Taxes on investment returns are also different between the two markets; European regulations require investors to pay a flat rate of 30% for capital gains, but in the USA, these tax rates differ based on state laws.

The point here is that asset management firms can eliminate non-compliance risks and augment the ROI of their clients by monitoring compliance requirements in different regions and adapting their compliance workflows to meet these requirements.

Varied regulatory requirements for different investment assets

Investors now have several investment assets to choose from including securities, government bonds, shares, cryptocurrencies, fixed assets, and more. New investment assets are also being introduced at an increasing rate.

Although these are all classified as investment assets, laws and regulations that govern them are different.

For example, most investment management firms are limited on how they can diversify their investments—regulators restrict the right to invest the majority of their investment in high-leverage, short-term investment assets.

One of the reasons for this is that high-leverage assets, while providing greater returns, are volatile and can lose asset management companies billions of dollars of their clients’ wealth. The rise and spectacular fall of Bill Hwang’s Archegos Capital Management is a prime example—the company lost $20 billion in two days.

Regulators also ban investing in certain assets like Bitcoin—in March 2021, India proposed a ban on mining and investing in cryptocurrency.

Monitoring compliance is key to avoiding hefty fines

Finally, the most obvious argument for monitoring compliance is to avoid lengthy legal battles and hefty fines. In recent years, regulators have been strict on enforcing regulations and have handed out hefty sanctions for non-compliance.

In the UK, for instance, the FCA fined Aberdeen Asset Management £7.2 million in 2013 for failing to comply with investment protection regulations. In China, the regulators fined the state-owned ICBC bank for 54.7 million Yuan for illegally investing its wealth management funds on restricted financial assets.

Compliance monitoring is key to protecting modern asset investments

As investing becomes more accessible and wealth management funds become more valuable, asset management companies need to do their due diligence in investment diversification and compliance management to protect these investments.

Monitoring compliance is a key component of that process.