Regulatory and Compliance Workflows

Institutions often perform and follow workflows to comply with their legal and regulatory requirements. These workflows can range from workflows for managing internal regulatory change, external regulatory interactions with regulators and supervisory authorities, compliance self-assessment workflows driven by regulatory requirements or a workflow to perform period compliance monitoring.

Regulatory and Compliance Workflows in FinregE

FinregE provides readily available digitised workflows for common legal and regulatory compliance workflow processes. FinregE can also build bespoke and custom digitised workflows to automate any repetitive and periodically performed business processes which involve action management, decision making, approvals, requests, data management , tasks lists and user interactions.

What is Compliance monitoring and self-assessments workflows?

FinregE can provide compliance monitoring workflows based on a review of regulatory requirements, company policies, procedures, controls and operational infrastructure.

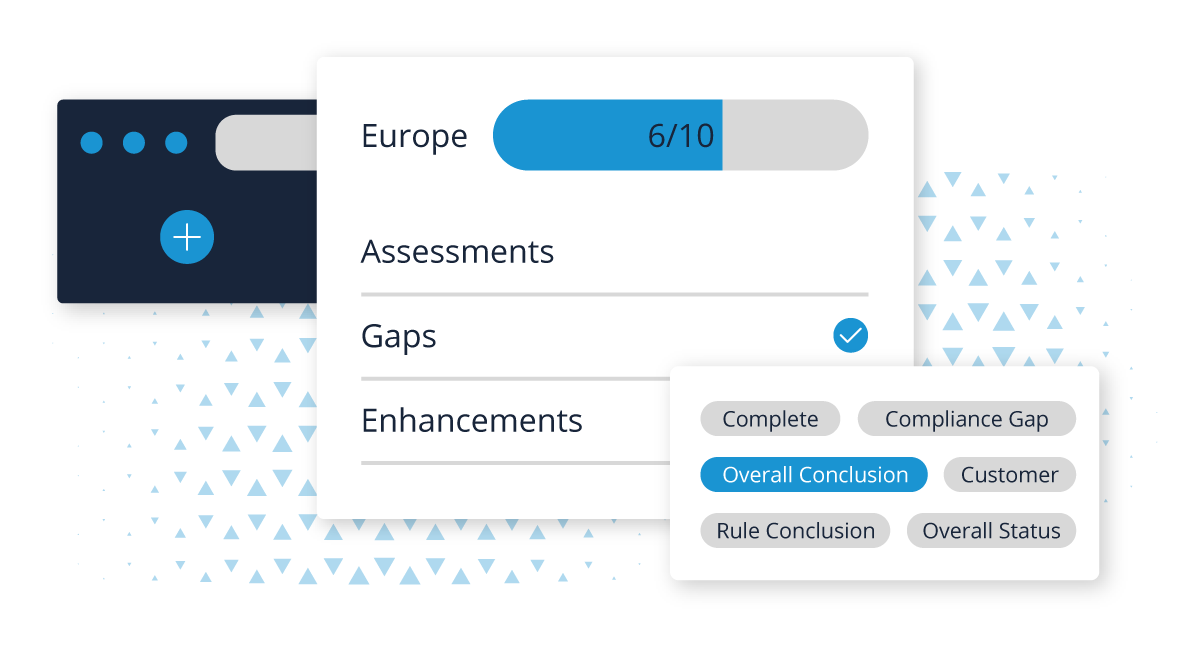

FinregE compliance monitoring workflow provides a joined-up, digitised solution for performing annual compliance monitoring for managing and maintaining an institutions compliance against its regulatory and legal requirements, and ensuring internal policies, procedures and operational infrastructure are designed in accordance with laws and regulations. FinregE’s compliance monitoring workflow provides inbuilt capabilities to define tests against regulatory requirements and internal processes and upload evidence confirm pass and fails of compliance tests, aswell as define gaps and enhancement required, and track them until resolved. FinregE also consolidates the outputs and results from an institution’s annual compliance monitoring activities to drive the a calendar of compliance monitoring testing for subsequent years.

FinregE compliance monitoring workflow comes with data visualizations and reporting to track, collate and present management information associated testing, with year on year comparative results and detailed focus on current year results. The workflow also provides an Overdue and Complete Assessment screens for workflow management to easily manage/track tests that are overdue their required complete dates and tests that are completed, versus tests which are on track and being assessed.

FinregE Compliance Monitoring Plan

Policy, process and control libraries for policy / process / control driven compliance reviews

Where your compliance monitoring plan is driven by a review of your policies, procedures and controls, FinregE can provide digital libraries of these documents to drive the institutions internal compliance testing and audit program.

Regulatory rule libraries for compliance testing

Where your compliance monitoring plan is driven by a review of your legal and regulatory rule requirements, FinregE can provide digital libraries rules and associated regulatory and legal obligations to drive the institutions internal compliance testing and audit program.

Compliance testing workflow

A testing and assessment workflow which allows institutions to select and test the policies, associated processes and controls, or regulatory obligations from FinregE libraries, and record the monitoring assessment an institution requires against the compliance tests and questions.

Risk Library

A digital risk library which holds and allows an institution to maintain its risk inventory and connect it to the compliance monitoring to inform monitoring and risks.

Conflicts of Interest Library

A digital internal conflicts library which holds and allows an institution to maintain its conflicts inventory.

Operational Errors Library

A digital errors library which holds and allows an institution to maintain its errors inventory. The library will be accompanied with dynamic and interactive visualizations which summarize and display errors inventory universe.

Vendor, Outsourcing and Third Party Library

A digital vendor library which holds and allows an instituion to maintain its vendor inventory. The library will be accompanied with dynamic and interactive visualisation which summarize and display vendor inventory universe.

Editing, version control, auditing across libraries and workflows

FinregE provides functionality to be able to edit and update the information across its libraries and workflow. FinregE provides version control against the editing so an institution maintains full clarity on the changes made against its compliance inventories and data. FinregE will record actions performed across the libraries and workflow so a full audit trail is present against actions performed in FinregE.

FinregE Regulatory Interactions Management Workflows

FinregE’s regulatory interactions management solution provides a workflow and record keeping related interactions with supervisory and regulatory authorities.

Our regulatory interactions workflow process deliver the following functionalities:

- Documenting and managing an organised response to interactions with regulatory and supervisory authorities such as enquiries, meeting requests, inspections, examinations.

- Sending workflow generated requests and notifications to responsible stakeholders across an institutions functions involved in interactions response process.

- The ability to use predefined workflow templates or custom create templates based on individual requirements under regulatory requests and interactions.

- The ability to link regulatory interaction events to regulatory rules and requirements under rules against FinregE global libraries.

Benefits of FinregE Regulatory And Compliance Workflows

- All centralised solution that brings disintegrated data related to regulatory rules, internal governance, risk and compliance and regulatory requests in one single place.

- A single place to define the scope and definitions under regulatory workflows allowing all stakeholders to understand scope of regulatory assessments, regulatory interactions and compliance monitoring exercises.

- A digitised way to define and track roles, responsibilities and timelines across organisational structure such as business lines, functions, products, services, activities and themes of regulations.

- Automated notifications, reminders and email alerts based on news task assignments and outstanding/overdue workflow tasks.

- Dynamic, interactive and drillable dashboards and reports to provide management information and insights into actions, owners, approvals, status, priorities, due dates, overdue tasks and patterns and trends.

- Ability to record evidence and testing against regulatory assessments, regulatory remediation and regulatory interactions, including areas of gaps and remediation, and plan of action to remediation.

- Single database with one version of all comments

- Permission controlled access

- In-built logic in user interface and functionality detects and prompts data validation e.g. days past due on actions

- Easy to control restrictions and permission of access to data at group and user level

- Complex processes are easy to create and maintain in software

- Version control and time-stamps easily maintained and retrieved

- Built in dynamic summaries of data and management information

- Easy for multiple users to input and save data at same time

- Supports many-to-many relationships (e.g. single owner managing multiple rules as assessor, reviewer, gap owner)

- Configurable automated notifications

- Tracking made easy by built-in dynamically updating dashboards

- Easy to set permissions across users and data

- More formalised and managed IT spend

- Audit trail with time stamps and retrievable version control

- Formal e-sign-off process built in

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.

FinregE’s Compliance Solutions

Real Time Rule Monitoring

Monitor compliance in real-time: both your status and processes

Digital Rulebooks

Access machine-readable libraries of financial global rulebooks

Regulatory Obligations

Extract insights on regulatory actions and requirements across rules

Rule Mappings

Map rule requirements automatically across your compliance policies

Compliance Workflows

Use workflows to action and record the life cycle of regulatory compliance

Compliance Dashboarding

Conduct compliance reporting with dashboards to view your landscape

Frequently Asked Questions

What is the best workflow management system for financial compliance?

There are many ways to optimise workflow management for financial compliance, including the use of automated technology.

Using automation, one way to create an effective compliance management system for your company is to focus on setting up a bespoke workflow. When automated, workflow management can reduce your costs while ensuring that your institution remains compliant with existing and emerging regulations.

Which financial compliance processes can be automated?

Depending on the type of software you use and your objectives, most financial compliance processes can be automated. That said, it’s recommended that you focus on automating practices that don’t require too much skill and those that otherwise take plenty of time.

One example is horizon scanning for regulatory change, which can be a complex, time-consuming task if done manually.

Automated regulatory horizon scanning tools, on the other hand, scan the regulatory landscape for updates and inform compliance teams in real-time, saving plenty of time and resources, and making this process ideal for automation.