FinregE End to End GRC with AI-Integrated Solutions

FinregE provides the world first end to end Governance, Risk, and Compliance solution completely revamps traditional GRC methods.

Our platform fully connects regulatory intelligence, regulatory rules and obligations, risks, controls, policies, process management, test plans and management, compliance automation, and audit management together, coupled with machine learning and artificial intelligence at every step.

FinregE’s solution not only ensures unparalleled efficiency and accuracy but also delivers process efficiency, risk mitigation, and strategic alignment with legal and regulatory mandates, offering AI generated insights leading a transformative impact on the way organizations manage their governance, risk, and compliance challenges.

Our platform meets industry security and confidentiality standards.

FinregE’s GRC Solutions

Horizon Scanning with Integrated GRC Impacts

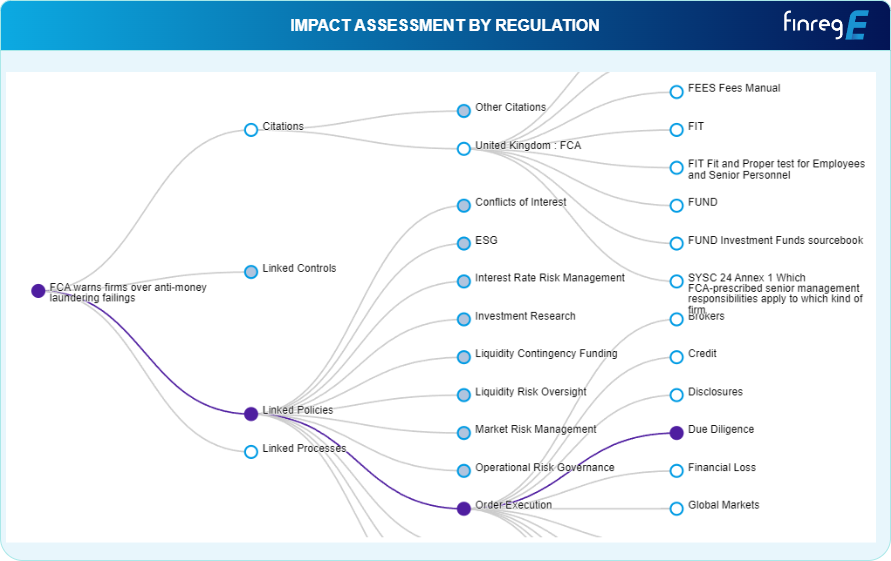

FinregE’s horizon scanning not only provides regulatory intelligence on changes rules, regulations and policy initiatives, but also suggests where new regulatory changes impacts existing policies, procedures, risks and controls.

Our horizon scanning provides direct citations to the relevant rules in emerging changes to quickly inform on in scope rules based on institutional regulatory footprint.

FinregE’s advanced AI and Machine Learning techniques also analyse and interpret regulatory changes against internal GRC data such as policies, procedures risks and controls, so relevant internal and external data connections are established to inform on where and how regulatory changes impact.

FinregE’s horizon scanning functionality provides a user-friendly interface with a variety of filter and selection options available to identify and hone in on strong signals in a timely manner.

Further, FinregE works with each client to customize the full platform functionality, ensuring a smoother end user experience and overall work efficiency.

Digital Legislative and Rules Libraries with GRC Integration

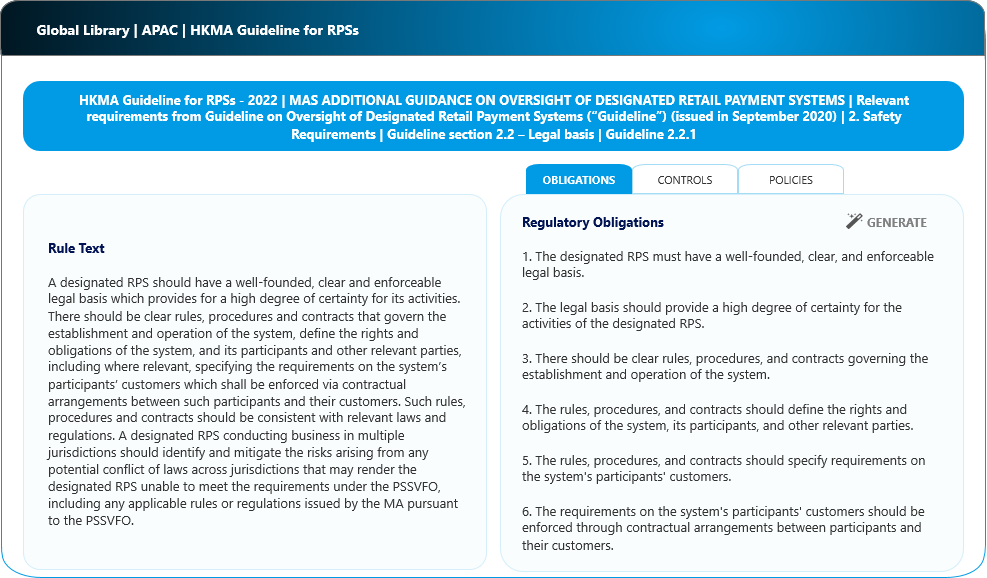

FinregE provides comprehensive suite of Regulation and Legislative Digital Rule Libraries, designed to seamlessly integrate, map, manage, and align to internal policies, processes, risks, and controls with relevant legislation, ensuring understanding, traceability, and accountability of legislative compliance within your operations.

FinregE’s Digital Regulation Libraries are dynamic and interconnected with our cutting-edge Horizon Scanning capabilities. This integration ensures that the horizon is continuously monitored for any changes to legislative and regulatory requirements. When changes are identified, our system provides actionable insights, enabling you to assess the implications and make necessary adjustments to your policies and controls promptly.

Key Features

Map existing policies, risks, and controls to specific legislative and regulatory requirements to ensure relevant regulatory rules to internal operations is accounted for, providing a clear view of your compliance landscape and traceability.

Fully integrated workflow facilitates a streamlined process to manage compliance. From identifying to implementing changes in policies and controls, and testing controls linked to rules, FinregE supports each step, ensuring efficiency and minimizing the risk of oversight.

FinregE’s Horizon Scanning is connected to its regulation libraries to ensure users are made aware of in scope rules that are undergoing changes, changed rules and associated policies and controls which review against proposed/changes rules and regulation.

Our Regulation and Rules Libraries cover a broad spectrum of legislative and regulatory requirements across jurisdictions. Whether you’re operating in a single country or across multiple international markets, our platform provides the coverage you need to ensure global compliance.

FinregE’s Regulation and Rules Libraries are further enhanced by the integration with our proprietary AI Regulatory Insights Generator (AI RIG). RIG provides suggested regulatory obligations, providing tailored recommendations for policies, processes, and controls associated with these obligations.

Risk Libraries

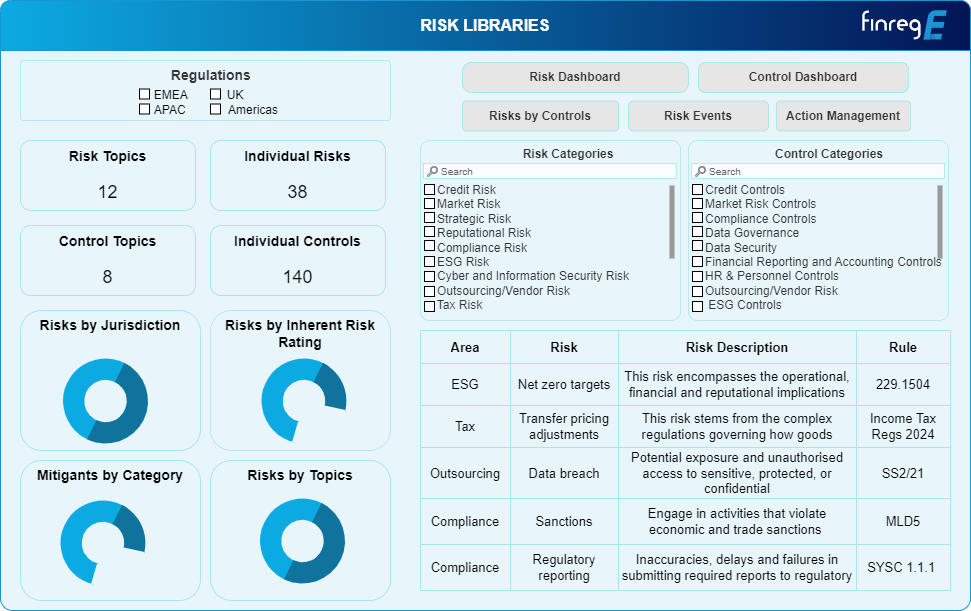

FinregE’s GRC Risk Libraries provide the structure and data to identify, assess, and manage risks with precision.

Our solution facilitates a multi-dimensional classification of risks, including inherent, residual, and target levels, ensuring risks are systematically captured from diverse sources, categorized by likelihood and impact, assigned to responsible owners, and aligned with predefined tolerance levels.

Key Features

As your business evolves, so does your need for a robust risk management system. FinregE’s platform is designed for scalability, ensuring that your risk management capabilities expand seamlessly alongside your business growth.

Leverage the power of AI to gain deep insights into potential risks. Our advanced analytics drive strategic decision-making and proactive risk management, enabling your organization to stay ahead of possible threats.

Our solution supports comprehensive risk scenario planning and impact analysis. This critical functionality prepares business units with the knowledge to implement effective risk mitigation strategies promptly.

At the core of our platform is the Risk Registry, a dynamic feature that allows for the ongoing monitoring and management of all identified risks and their current statuses. Integrated reporting capabilities offer immediate access to risk information, enhancing visibility and control.

Aids in the prioritization of risks and the efficient allocation of resources by visually representing the severity and likelihood of risks.

Generates valuable insights and tracks risk performance, supporting informed decision-making and continuous improvement.

Offers scenario testing to better inform risk mitigation plans, allowing your organization to prepare for a range of outcomes.

Utilizes historical data and trend analysis to predict potential business behaviours and associated risks, enhancing your risk preparedness.

Control Libraries

FinregE’s GRC Control Libraries enables you to design, record and implement effective controls, specifically tailored to address the unique risk landscape of your organization. Integrated with FinregE AI RIG, controls can also be suggested against regulatory obligations or organisational activities to enrich and fill gaps in controls versus regulatory and internal process requirements.

Key Features:

Users can create and maintain a detailed inventory of all controls implemented across their business units. This centralized inventory allows for enhanced categorization of controls by risk and/or regulation, and the ability to link relevant controls, fostering a cohesive risk management strategy.

FinregE facilitates the mapping of inherited controls from parent entities to subsidiaries. This feature minimizes redundancy and streamlines control management throughout the organization.

Users can capture detailed procedures, the rationale behind each control, and the specific testing methodologies required, along with associated deadlines. This ensures a comprehensive understanding and management of each control.

Test results for controls can be efficiently documented against controls and testing frequencies, facilitating enhanced reporting on control effectiveness. This approach to documenting test outcomes ensures transparency and accountability.

FinregE empowers users to proactively address control deficiencies. Users can input and monitor remedial measures, detailing corrective actions and assigning ownership. The progress of these measures is tracked within the system, with automated alerts for overdue actions to ensure timely resolution.

The Controls module includes functionalities for the automation of routine or scheduled controls testing and reporting. This automation not only saves time but also ensures consistency and reliability in controls management.

Our solution provides seamless integration with risk assessments, enabling continuous monitoring of controls to identify vulnerabilities and ensure that control strategies are aligned with the current risk landscape.

As with all modules in the FinregE, the Controls module ensures clear audit trails of all activities. These trails are readily available, providing transparency and facilitating compliance with regulatory requirements.

FinregE GRC Policies and Procedures Libraries: Streamlining Policy Management

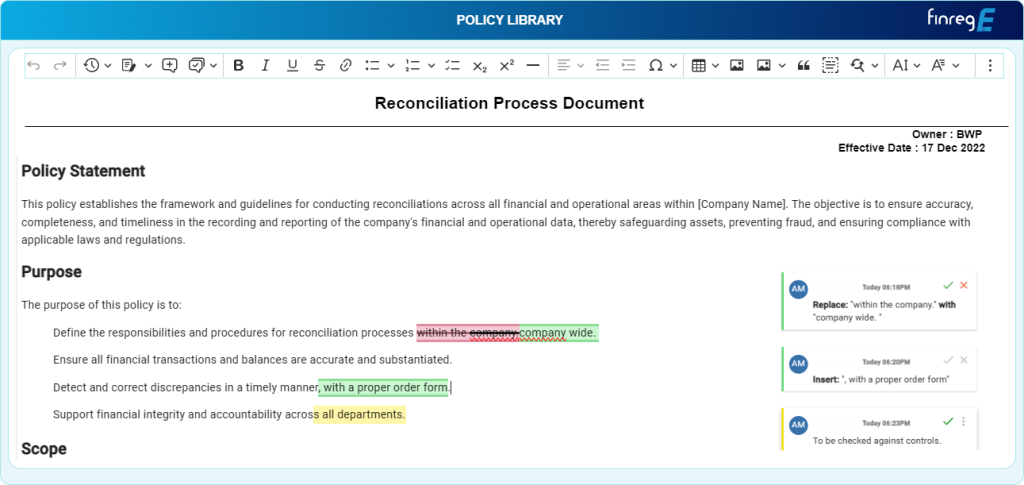

FinregE’s Policies and Procedures Libraries provide capabilities for creation, management, and dissemination of organizational policies and procedures.

Fully connected with our generative AI RIG, Digital Rules, Risks and Controls Libraries, FinregE provides the unique capability to ensure your policies not only align with organisational compliance data and profile, but also with regulatory requirements. Leveraging AI-driven insights, FinregE provides recommendations, aligned to regulatory expectations, internal risks profile and associated controls for policy and process enhancements and updates.

Key Features

A centralized Policy and Procedure Repository, housing historical policies in various formats, allowing for the effortless creation of new policies and the revision of existing ones, all tailored to specific user access levels.

FinregE’s platform is equipped with sophisticated drafting tools that feature tracked changes, enabling a transparent revision process. Commenting and collaboration capabilities are embedded within the platform, facilitating a cooperative approach to policy and procedures development. These tools are complemented by built-in governance and approval workflows, ensuring that each document undergoes a rigorous review process before finalization.

Detailed audit trail for every policy change, including versions and user activity, to ensure full compliance and accountability. Automatic routing of policy drafts, along with deadline management and notifications to stakeholders, streamlining the approval process and keeps all relevant parties informed.

With the ability to map policies to specific regulatory rules and link them to multiple business units involved in policy development, FinregE ensures a holistic approach to policy management. Access controls for sensitive policy information are robust and easily managed within the system, safeguarding critical data.

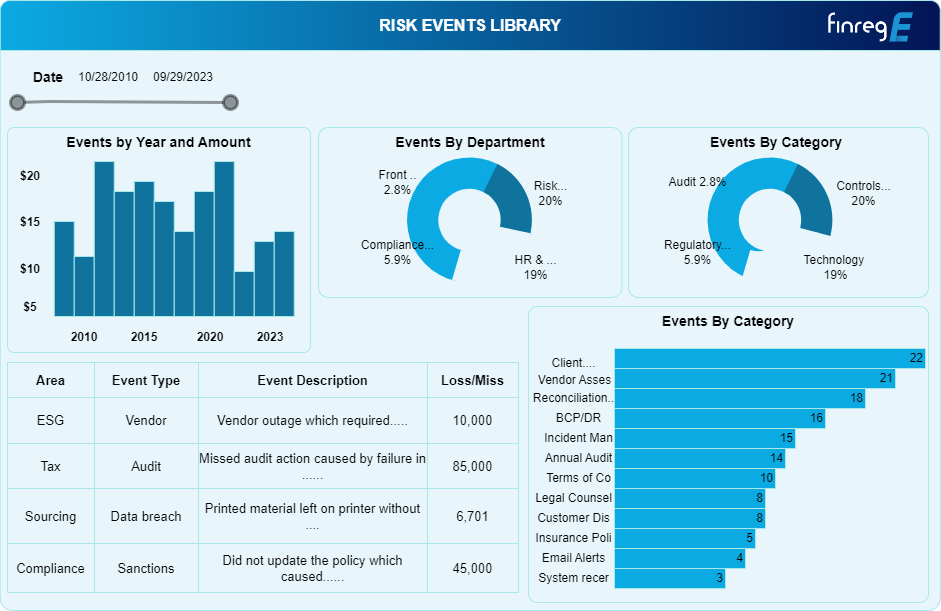

Risk Events Libraries: Enhancing Incident Response and Analysis

FinregE’s Risk Events Libraries offer a solution for the real-time capture and analysis of risk events and operational risk management. Our platform is designed to streamline the process of recording incidents, near misses, their underlying causes, and loss data facilitating a proactive approach to risk management.

Key Features:

With FinregE, risk events can be reported directly through the platform, as well as via email and text message, ensuring no critical information is missed. This flexibility allows for immediate action and analysis, regardless of how the information is received..

Our system enables risk events to be classified according to severity, type, and potential impact on associated business units. This classification aids in prioritizing response efforts. Additionally, our platform fosters efficient communication among all business units linked to a risk event, enhancing collaboration and ensuring a coordinated response.

Assigned owners of a risk event have the capability to propose corrective actions directly within the system, addressing the root causes to prevent future occurrences. Leveraging AI technology, FinregE provides trend analysis to identify patterns and gaps, offering insights to strengthen controls or implement new preventative measures.

FinregE’s GRC suite includes comprehensive reporting functionalities to fulfill regulatory requirements and support informed decision-making. The risk events dashboard offers a panoramic view of the event lifecycle, from identification and investigation to containment, mitigation, recovery, and beyond.

Rules can be established within the platform to trigger automatic notifications to stakeholders and risk owners when thresholds are breached, supporting timely escalation and response. Our platform also includes Root Cause Analysis tools at both the risk and event level, enabling a deep dive into contributing factors and fostering a robust operational resilience strategy.

FinregE’s scenario planning and testing functionality empowers business units to identify potential vulnerabilities in advance. This proactive feature assists in improving risk event identification, enhancing response times, minimizing operational impacts, and contributing to a comprehensive operational resilience framework.

Action Management Workflow: Streamlining Task Execution

FinregE’s unique Assessment and Action Management Workflow deliver automation and collaboration in how an organization tracks and manages actions, delivering efficiency and precision in handling tasks related to risks, compliance, and audit findings. FinregE delivers enhanced collaboration, reporting, accountability and notification capabilities in action management processes, ensuring actions are allocated, assigned, and resolved in a timely manner.

Key features

FinregE facilitates the creation and management of action plans with detailed descriptions, clear allocation of resources and ownership, and defined timelines. This structured approach allows for seamless tracking of action items, ensuring accountability and progress monitoring at every stage.

With FinregE, action items are continuously tracked and collated at the business level, offering real-time insights into completion rates and outstanding actions. The platform includes robust procedures for escalating actions that are overdue or hindered by unassigned or unapproved resources. Notification tracking ensures that relevant stakeholders are informed and able to acknowledge required actions promptly.

Actions are prioritized based on associated risk levels, ensuring that critical tasks are addressed promptly. FinregE allows for the grouping and linking of actions to risk assessments, controls, and outputs from risk scenario modeling, among other relevant data. This integration enhances visibility and ensures a cohesive approach to action management.

All documents related to action management, including remediation plans, policy documentation, and risk assessments, are securely stored within the platform. These documents are easily accessible to relevant business units and users, facilitating informed decision-making and strategy implementation.

Actions are prioritized based on associated risk levels, ensuring that critical tasks are addressed promptly. FinregE allows for the grouping and linking of actions to risk assessments, controls, and outputs from risk scenario modeling, among other relevant data. This integration enhances visibility and ensures a cohesive approach to action management.

The FinregE GRC suite elevates action management by highlighting critical tasks before they become incidences. This proactive approach to managing actions enhances compliance, promotes accountability, and supports strategic decision-making across the organization.

GRC Testing: Ensuring Control Effectiveness and Compliance

Unlock the full potential of your governance, risk, and compliance strategy with FinregE’s advanced testing capabilities. Our platform is meticulously designed to validate the effectiveness of your controls and policies, employing AI-enhanced analytics to deliver comprehensive insights into test results and compliance levels.

With FinregE’s robust testing functionality, your organization can develop and refine controls to ensure they function as intended, effectively mitigating risks and enhancing compliance. Our platform not only streamlines the testing process but also equips you with the data-driven insights needed to navigate the complexities of the risk environment confidently.

Key Features

FinregE empowers your organization to meticulously develop and execute detailed test plans. Our platform facilitates the creation, management, and version control of various test plans tailored to assess the myriad components across its modules, including risk and risk events. With the option to incorporate historical tests or industry-standard practices into testing templates, our system ensures your testing strategies are both thorough and relevant.

Leverage the power of automation to prioritize testing plans based on the associated risk level and the potential impact of control failure. This ensures that your testing efforts are focused where they are most needed, enhancing the efficiency and effectiveness of your risk management practices.

Assign testing tasks effortlessly to users, complete with clear deadlines and detailed requirements. Our platform allows for the secure capture and storage of all testing evidence, including audit logs and supporting documentation. This structured approach ensures accountability and facilitates a comprehensive review process.

Upon the completion of testing tasks, users can easily identify any control vulnerabilities or instances of non-compliance. The platform allows for the detailed documentation of issues, remedial plans, and completion status, ensuring that corrective measures are tracked and implemented effectively.

FinregE offers a holistic view of the testing process, with seamless integration to risk assessments and control mechanisms within the system. This integration promotes a comprehensive understanding of your control environment and its effectiveness in mitigating risks.

Our platform supports self-assessment functionalities, empowering users to take ownership of control effectiveness. Comprehensive reporting on testing results, control efficacy, identified vulnerabilities, and overall test performance is readily available, enabling informed decision-making and strategic planning.

Data Analytics and Reporting: Unlock the Power of Your Data

Unlock the full potential of your data with FinregE’s advanced Data Analytics and Reporting capabilities. Our platform transforms complex data into actionable insights, enabling you to make informed decisions that enhance your Governance, Risk, and Compliance (GRC) strategy. With our suite of tools, including interactive dashboards, heat maps, and custom reports, you’ll gain a comprehensive view of your GRC status at a glance. Leveraging the power of AI, our system not only identifies current areas of concern but also anticipates future opportunities for improvement.

Our platform is designed to foster a culture of collaboration and knowledge sharing. Users can add comments, insights, and recommendations directly within the data analytics workflow, making complex analyses accessible and understandable to all. This inclusive approach empowers every team member with the knowledge to make data-driven decisions, elevating your organization’s overall GRC strategy.

Key Features

FinregE’s GRC platform simplifies the integration of data from diverse sources, encompassing everything from testing results and risk assessments to policy documents and regulatory updates. This holistic approach ensures you have all the information you need to conduct thorough and accurate analyses.

Our platform empowers users to maintain high data quality standards. Users can easily comment on, and address issues related to data cleanliness and standardization, ensuring consistency and reliability across datasets. Every amendment is meticulously tracked, facilitating auditability and transparency in data handling.

Experience data like never before with user-friendly dashboards and reports, featuring modular visualizations such as charts, graphs, and maps. Anomalies are clearly highlighted, allowing for immediate notification of relevant stakeholders and fostering a proactive approach to data integrity across your organization.

Stand out with our benchmarking and gap analysis feature, which compares your GRC performance against industry standards and historical data. This powerful functionality helps pinpoint areas for enhancement, guiding your journey towards excellence.

Dive deeper with FinregE’s array of advanced analytical tools:

Predictive Analytics: Foresee potential risks and compliance gaps with sophisticated predictive models.

Scenario Modelling: Navigate regulatory and economic changes confidently with detailed scenario analysis.

Root Cause Analysis: Identify and mitigate the underlying causes of risks and control failures.

Machine Learning & AI: Automate routine tasks and uncover trends with cutting-edge technology.

Text Analytics: Extract valuable insights from unstructured data, including emails and documents.

Our platform is designed to foster a culture of collaboration and knowledge sharing. Users can add comments, insights, and recommendations directly within the data analytics workflow, making complex analyses accessible and understandable to all. This inclusive approach empowers every team member with the knowledge to make data-driven decisions, elevating your organization’s overall GRC strategy.

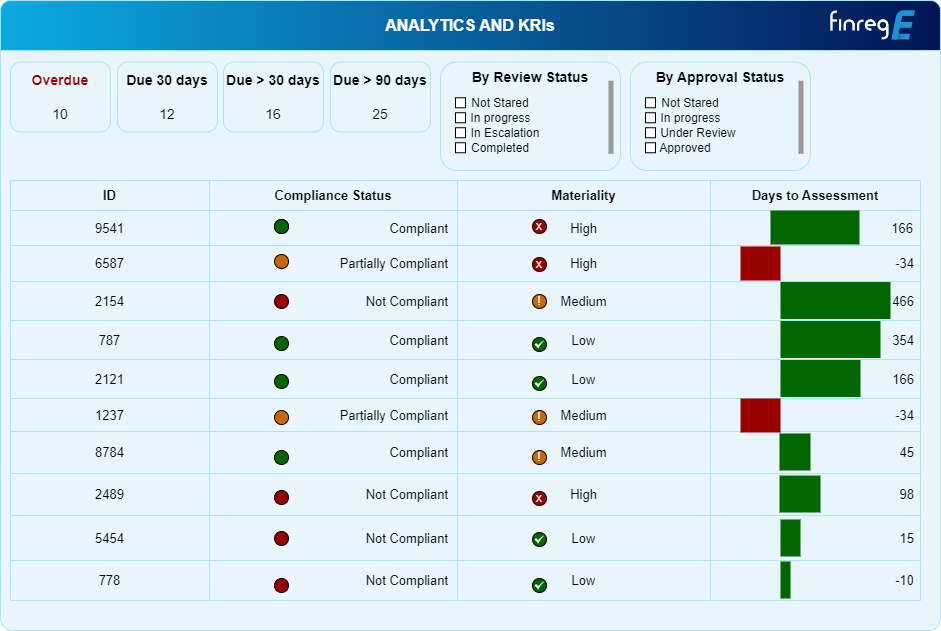

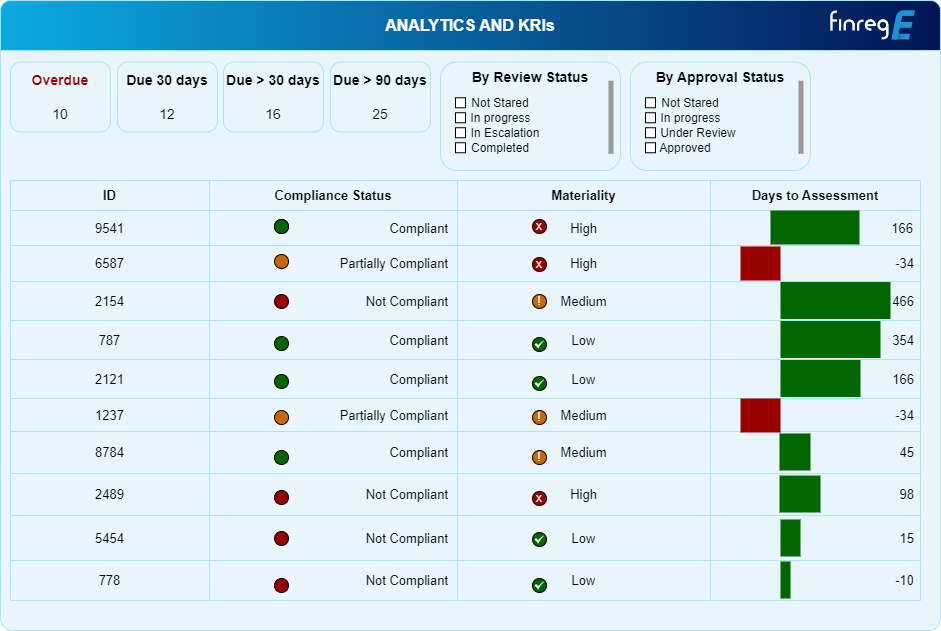

Key Risk Indicators (KRIs): Precision in Risk Management

Master the art of risk management with FinregE’s innovative Key Risk Indicators (KRIs) module. Our state-of-the-art platform is meticulously designed to simplify the setting and monitoring of KRIs, enabling seamless adaptation and integration across every facet of your organization. With the power of AI-driven analysis, we ensure the precise tracking of KRI performance, aligning effortlessly with your risk appetite and strategic objectives.

FinregE’s KRI module empowers your organization to navigate the complexities of risk management with precision and confidence. By leveraging advanced AI analytics and customizable features, you can ensure that your risk management efforts are proactive, informed, and aligned with your business objectives.

Key Features

FinregE’s GRC Risk module revolutionizes KRI management by providing a sophisticated system for capturing, quantifying, and analyzing KRIs using clear metrics such as percentages, ratios, or straightforward numerical values. This functionality allows for easy tracking and in-depth analysis of each indicator, ensuring that you stay ahead of potential risks.

Our platform enables you to establish benchmarks and thresholds for each KRI, tailored to the unique needs and risk profile of your organization. Automatic alerts notify you when KRIs exceed their acceptable limits, allowing for prompt and effective response to emerging risks.

Flexibility is at the heart of the FinregE platform. Whether you prefer to utilize preset standards or customize KRIs to fit your specific business needs, our system accommodates your strategy. Customization options include the grouping of KRIs by business unit or process, ensuring relevance and clarity in risk management.

The KRI module is intuitively linked with Risk Assessments within the FinregE platform, bridging the gap between identified risks and their corresponding metrics. This integrated approach enhances your ability to pre-emptively address and mitigate risks, bolstering your organization’s resilience.

Gain instant access to critical insights with our advanced reporting and dashboard functionality. Designed to present and track KRI data effectively, our system provides stakeholders with the information needed to develop informed mitigation strategies and make data-driven decisions.

Pioneering AI RIG LLM Integration in GRC Solutions

FinregE is proud to stand at the forefront of innovation in the Governance, Risk, and Compliance (GRC) as the first software solution to seamlessly integrate Artificial Intelligence (AI) and our Large Language Model AI RIG into our GRC. This pioneering integration elevates the capabilities of our solutions versus traditional GRC, transforming the landscape of GRC management with advanced technology that touches every aspect of the field.

By integrating AI RIG into our GRC solutions, we are not just providing tools; we are shaping the future of GRC management. Our innovative approach allows users to navigate the complexities of governance, risk, and compliance with unprecedented ease and efficiency. Experience the next generation of GRC technology with FinregE, where cutting-edge innovation meets robust, reliable GRC management solutions.

Key Features

Our AI RIG integration bring predictive insights, automation of complex processes, and enhanced risk identification. It streamlines compliance management and supports decision-making processes, fundamentally redefining the possibilities within GRC technology. The introduction of LLMs into our ecosystem significantly amplifies our GRC offerings, enabling comprehensive analysis and processing of vast amounts of data from diverse sources including policy notices, regulatory publications, and incident reports.

The FinregE horizon scanning fully integrated with RIG facilitates staying abreast of the latest regulatory changes and identifying potential future disruptions by analysing industry trends. By automating the review of regulations and other critical documents, our technology not only saves time but also enhances efficiency and minimizes the risk of gaps and errors in interpretation and consolidation.

Our integrated RIG capabilities excels in classifying documents, mapping their contents against existing policies and controls, and highlighting any discrepancies. This feature ensures that your GRC efforts are comprehensive and precise

The Risk and Testing modules of our platform benefit greatly from RIG’s ability to propose testing scenarios based on historical data and best practices. This advanced capability ensures that your risk management strategies and testing protocols are both effective and informed by a wealth of knowledge and insights.

At FinregE, we understand the importance of data privacy, sensitivity, and ethical handling. We have taken steps to ensure our Generative AI integration via RIG adheres to the highest standards of data management.

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.