Generative AI provides firms with the tools needed to analyse, summarise and align policies with new regulations.

For most financial firms, managing policies and regulatory documents is slow, manual and error prone. Keeping up with constantly changing regulations can be tiring and the cost of non-compliance can be detrimental.

This is where Generative AI (GenAI) comes in.

FinregE incorporates generative AI directly into its compliance platform to help firms map internal policies to regulations, monitor regulatory change in real-time, and streamline how policies are written, reviewed, and maintained.

Why efficient policy management matters

Managing policies efficiently is not only a regulatory requirement, it is essential for your operational integrity and generating trust among your customers.

It also helps to prevent regulatory fines and reputational damage.

Whether it’s theinancial Conduct Authority (FCA), the European Banking Authority (EBA) or the Federal Deposit Insurance Corporation (FDIC), regulators worldwide are increasingly highlighting the importance of policy management to ensure financial stability and compliance.

FINRA, the Financial Industry Regulatory Authority, said in their regulatory notice that “firms must maintain clear policies governing how technology is used to ensure oversight, accuracy and consistent compliance as tools evolve”.

The problem is that most firms are stuck with static templates, scattered ownership, and limited capacity to track changes across global regulations.

This is the gap generative AI can fill.

How generative AI Is changing the game

Generative AI is redefining what’s possible in document management.

By automatically analysing, summarising, and drafting policy content, it drastically reduces the time and resources needed for policy development and maintenance.

Generative AI helps businesses to analyse, summarise and draft policy content which in turn reduces the time needed for writing and maintaining policies.

Key capabilities include:

- Auto-draft policy content from regulatory templates

- Summarise complex rulebooks into plain language

- Track changes across multiple policy versions

- Map internal controls to external obligations

This means fewer missed updates, faster reviews, and better alignment across the business.

How FinregE transforms policy management with generative AI

Managing policies manually in financial services is a losing game.

Rules change constantly, documentation gets outdated fast, and compliance teams are stuck reconciling internal controls with global regulations.

FinregE flips this model by applying generative AI to every stage of the policy lifecycle, from drafting and mapping to ongoing alignment and governance.

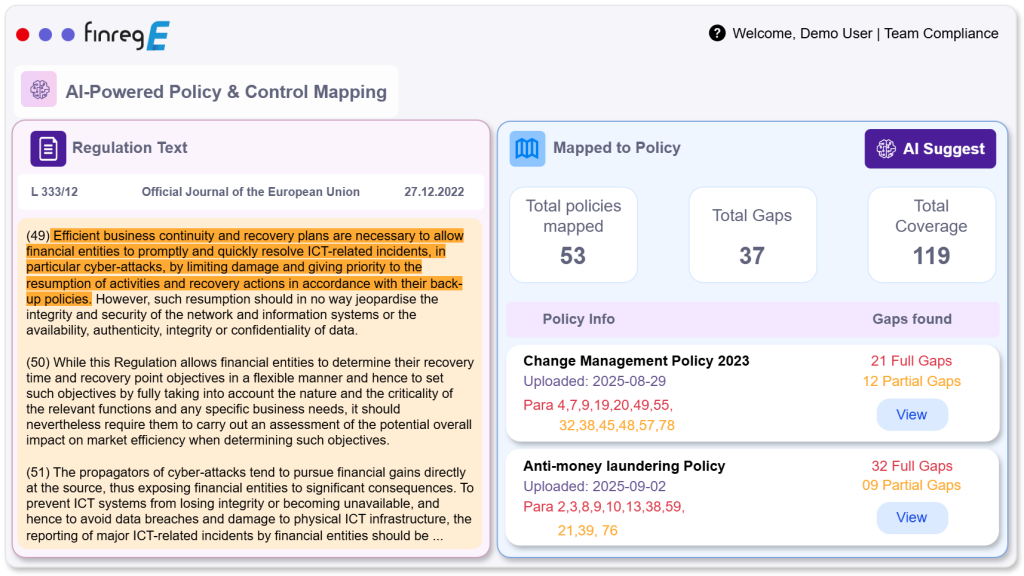

Policy mapping with RIGMAPS

FinregE’s RIGMAPS module reads your policies, control documents, and regulatory texts and turns them into a single, connected view. It uses natural language processing (NLP) and proprietary AI to:

- Map internal policies to live regulatory requirements

RIGMAPS automatically scans your firm’s documentation and links it to relevant regulatory obligations, creating a traceable, auditable connection with zero manual effort. - Run gap analysis and suggest control fixes

It flags misalignments between your controls and regulatory expectations, then recommends specific enhancements to close the gaps. - Spot risks early

As new rules emerge, RIGMAPS continuously checks for impact, so you’re not caught off-guard when your policies fall behind. - Make ownership clear

It shows which business units and teams are responsible for each regulatory change, so action plans aren’t just created, they’re followed.

The result: your policy documentation becomes living, breathing, and always aligned with regulatory expectations.

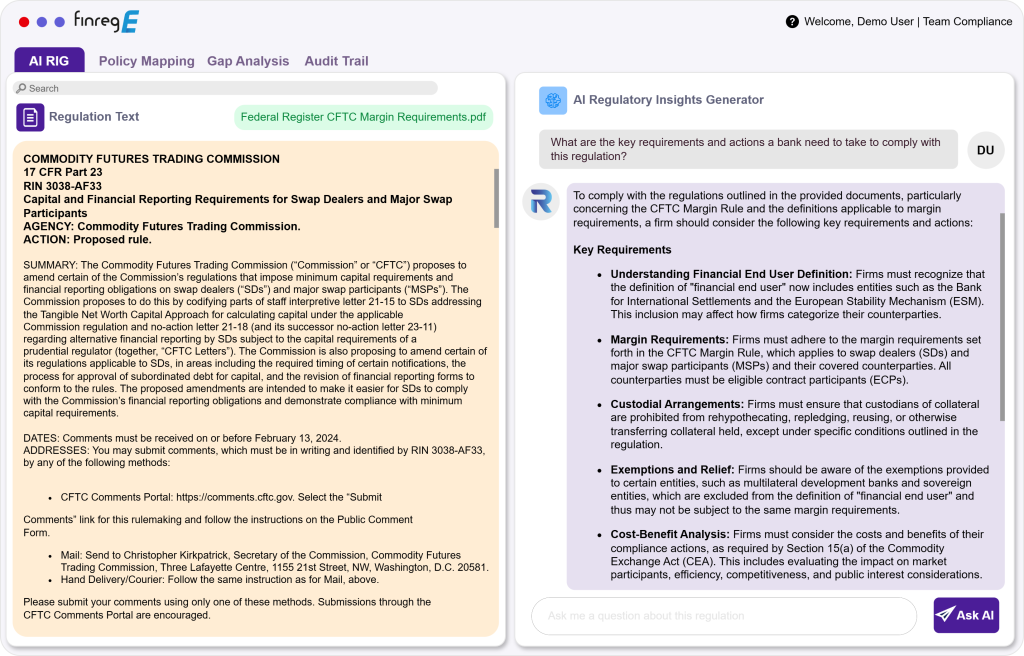

AI RIG – Your personal regulatory assistant

FinregE’s Regulatory Insights Generator (RIG) is like having a virtual policy analyst who never sleeps. It’s trained on global financial services regulations and built to understand how rules apply to your specific business model.

Here’s what RIG can do:

- Faster drafting of policies

RIG generates policy language based on your jurisdiction, sector, and regulatory profile. It’s not just filler; it’s grounded in real regulatory logic. - Summarise long, complex rulebooks

Instead of going through 200 pages of text, get plain-language summaries and highlights of what matters the most to your firm. - Deliver targeted compliance actions

RIG gives you obligation-specific guidance and control suggestions, directly tied to your risk environment. - Work across the platform

RIG feeds insights into RIGMAPS, rulebooks, and horizon scanning – so intelligence flows from monitoring through to execution.

End-to-End workflow integration

FinregE ties it all together. Whether you’re identifying new rules, adjusting policies, or running internal assessments, every workflow lives in one place.

- Real-time horizon scanning

Track global regulatory updates with filters and multi-language support. - Searchable digital rulebooks

Quickly find and compare requirements across jurisdictions, complete with annotations and version control. - Self-assessment workflows

Run SMCR attestations, track evidence, and produce board-ready MI reporting, without manual follow-ups. - Project management that is built for compliance

Turn regulations into actions. Assign tasks, track deadlines, and monitor delivery through dashboards and audit logs.

All of it syncs through notifications, trails, and reporting, so you don’t just react to change, you manage it.

Case study: Fast-tracking DORA compliance with FinregE

A mid-sized European bank needed to align 15 critical internal policies with the Digital Operational Resilience Act (DORA). That included AML, IT, and order execution policies, all benchmarked against Level 1 and Level 2 texts.

Here’s how they used FinregE:

- Captured the entire DORA corpus

Horizon Scanning pulled in the regulatory texts, technical standards, and RTS updates. - Mapped internal policies to DORA

RIG directly linked each internal policy section to relevant DORA articles, exposing gaps and overlaps. - Flagged what needed work

RIG showed which sections already met DORA expectations and which fell short. - Enhanced existing language

In policies that were close, RIG suggested small but crucial edits, especially in IT and cybersecurity wording. - Wrote new content where needed

Where policies were missing entirely, RIG generated draft language aligned to DORA’s operational risk standards.

The result: Full alignment in a fraction of the usual time. Fewer manual hours, less back and forth, and a policy stack that was DORA-ready and defensible under audit.

Why financial institutions choose FinregE

Regulation is never static. FinregE gives firms a living, breathing policy ecosystem. You get:

- Faster turnaround on policy updates

- Clear traceability from law to control

- Better coordination across teams

- Reduced compliance and legal risk

Whether you’re managing group-wide policies or business-line specifics, FinregE puts the right insights in front of the right teams, without any delay. Regulators aren’t slowing down. Neither should your ability to keep up. With FinregE, you could get a future-ready solution that turns regulatory change into a competitive advantage.

Ready to rethink your policy strategy? Book a demo today.