Regulatory Changes: A Constant Challenge

In today’s ever-evolving regulatory landscape, staying ahead of the curve is no longer a luxury, it’s a necessity. Businesses across industries face a constant barrage of regulatory changes – a dynamic labyrinth of evolving laws, directives, and amendments – each with the potential to disrupt operations, incur hefty fines, and damage brand reputation. The reactive approach of scrambling to comply after the fact is outdated and unsustainable. The penalties are swift and severe: operational disruptions, crippling fines, and a tarnished brand reputation.

The future of compliance lies in proactive strategies, a keen awareness of the regulatory horizon, and an embrace of innovative tools like predictive analytics and horizon scanning.

In this blog post, we’ll illuminate the imperative for proactive regulatory compliance in today’s turbulent environment. We’ll explore the pitfalls of the reactive approach, unveil the powerful potential of horizon scanning and predictive analytics, and equip you with the tools to navigate the complex terrain of ever-evolving regulations.

The Need for Regulatory Horizon Scanning

What is Horizon Scanning?

Regulatory horizon scanning, in essence, is a systematic and comprehensive approach to identifying and assessing potential regulatory changes that may impact an organization in the future. It delves beyond mere information gathering, actively analysing, interpreting, and disseminating intelligence on proposed amendments, legislative revisions, and emerging industry standards. The core objective is to provide advanced notice of forthcoming regulatory shifts, empowering organizations to prepare and adapt before the waves of change arrive.

This proactive approach offers a wealth of strategic advantages:

- Enhanced Agility: Early awareness of forthcoming modifications to regulations, laws and direction of change allows for swift adaptation of operational practices and business models. This agility minimizes disruption and enables organizations to capitalize on the potential opportunities presented by evolving regulations.

- Mitigated Risk: Proactive horizon scanning facilitates the identification and pre-emptive mitigation of potential regulatory hazards. This includes anticipating potential compliance failures, operational roadblocks, and reputational risks, empowering organizations to implement preventative measures and minimize negative consequences.

- Informed Decision-Making: A clear understanding of the future regulatory landscape fosters confident and informed strategic choices. Organizations equipped with this foresight can make well-calibrated decisions that ensure sustainable growth and long-term compliance.

- Boosted Stakeholder Confidence: Embracing a proactive approach to compliance strengthens an organization’s reputation for accountability and transparency. This fosters trust and confidence among investors, clients, and partners, solidifying an organization’s position as a responsible and reliable leader in its industry.

Implementing Regulatory Horizon Scanning for Compliance

Maintaining compliance in today’s dynamic regulatory landscape demands a forward-looking approach. Enter regulatory horizon scanning, a proactive strategy for identifying and analysing emerging regulations that could impact your business. By implementing a robust horizon scanning program, you gain the strategic advantage of anticipating change and proactively preparing your organization.

Best practices for successful implementation include:

- Formalize Regulatory Change Management: Establish clear procedures and responsibilities for tracking, evaluating, and responding to regulatory changes. Assign ownership and define escalation pathways for critical updates.

- Prioritize Based on Risk: Develop a risk rating framework to categorize upcoming regulations based on their potential impact on your operations, legal exposure, and business continuity. Focus resources on high-impact priorities.

- Curate Trusted Sources: Cultivate a reliable network of regulatory resources including official government publications, industry associations, and specialist news outlets. Stay informed through regular monitoring and proactive research.

- Leverage Technology: Consider utilizing dedicated regulatory intelligence software to automate scanning, track developments across multiple sources, and receive early-stage alerts for relevant changes.

- Foster Collaboration: Organize cross-functional working sessions involving legal, compliance, business units, and other stakeholders to collaboratively assess the implications of upcoming regulations and develop coordinated responses.

- Document and Share Insights: Maintain comprehensive records of change assessments, risk analyses, and recommended actions. Regularly communicate key findings and emerging trends to senior leadership and departmental teams.

Conquer Compliance Complexity with Streamlined Regulatory Changes Tracking and Management

By harnessing the power of horizon scanning, your organization can transform compliance from a reactive scramble to a proactive, orchestrated endeavour. Here’s how:

- Centralized Command Centre: Establish a real-time, centralized database housing both upcoming and recently enacted regulations. This single source of truth keeps everyone informed and aligned.

- Ownership with Ease: Implement a workflow functionality to seamlessly assign designated owners for assessing the potential impact of each regulation. Clear accountability breeds swift and efficient action.

- Risk Rating Refinery: Develop a standardized risk analysis rating criteria to consistently evaluate the compliance impact of each regulation. This data-driven approach allows for prioritized resource allocation and targeted action.

- Transparency at a Glance: Leverage dashboards and reports to visualize pending assessments, effortlessly prioritize tasks based on timelines and risk scores, and keep all stakeholders informed with a single, intuitive view.

- From Analysis to Action: Build functionality to develop, review, and approve recommendations and action plans directly within the system. Streamlined collaboration ensures swift translation of insights into actionable compliance strategies.

- Automated Alarms for Efficiency: Implement timely notifications whenever key assessment milestones are reached, guaranteeing prompt attention and preventing missed deadlines.

- Unwavering Documentation: Maintain a comprehensive audit trail capturing system data and user activities over time. This transparent record fosters accountability and facilitates continuous improvement.

By automating these tracking and management processes, you unlock the power of a sustainable, scalable approach to regulatory change oversight. Compliance becomes less of a burden and more of a strategic advantage, empowering your organization to:

- Confidently allocate resources based on data-driven risk assessments.

- Proactively adapt to new regulations, minimizing disruption and ensuring seamless compliance.

- Maintain a culture of continuous improvement with auditable records and feedback loops.

- Boost stakeholder confidence by demonstrating unwavering commitment to responsible compliance practices.

In today’s rapidly evolving regulatory landscape, embracing a proactive approach to change management is no longer optional, it’s essential. By empowering your team with the right tools and processes, you can transform compliance from a reactive headache into a proactive strength, propelling your organization towards unwavering operational excellence.

The Role of Predictive Analytics in Regulatory Compliance

Predictive analytics leverages historical data and statistical algorithms to forecast future trends and outcomes. In the context of regulatory compliance, predictive analytics can be a game-changer. By analysing past regulatory trends, organizations can anticipate potential future changes, allowing for proactive measures to be implemented.

Harnessing the Power of Predictive Analytics

Predictive analytics takes horizon scanning to the next level. By analysing vast datasets of regulatory data, trends, and emerging technologies, regulatory intelligence software can predict with increasing accuracy the likelihood and timing of future regulatory changes. This advanced foresight empowers businesses to:

- Identify emerging regulatory trends: Early detection of new trends allows businesses to proactively adjust their strategies and capitalize on new opportunities.

- Prioritize high-impact changes: Not all regulatory changes are created equal. Predictive analytics helps businesses prioritize changes based on their potential impact on the organization.

- Simulate potential scenarios: By simulating the impact of different regulatory scenarios, businesses can test their resilience and develop contingency plans.

Regulatory Automation and Compliance

Automating compliance processes via robotic process automation (RPA) and AI/ML can optimize regulatory change adaptation including:

- Automated data collection from regulatory sources to enable real-time horizon scanning.

- Natural language processing to rapidly analyse regulatory documents.

- AI-based impact modelling of new regulations on business units.

- Chatbots to handle regulatory change inquiries from staff.

- Voice analytics for calls assessing consumer protection regulation shifts.

Compliance automation amplifies team bandwidth to focus on high-value predictive analytics and regulatory engagement.

Utilizing Regulatory Horizon Scanning Tools

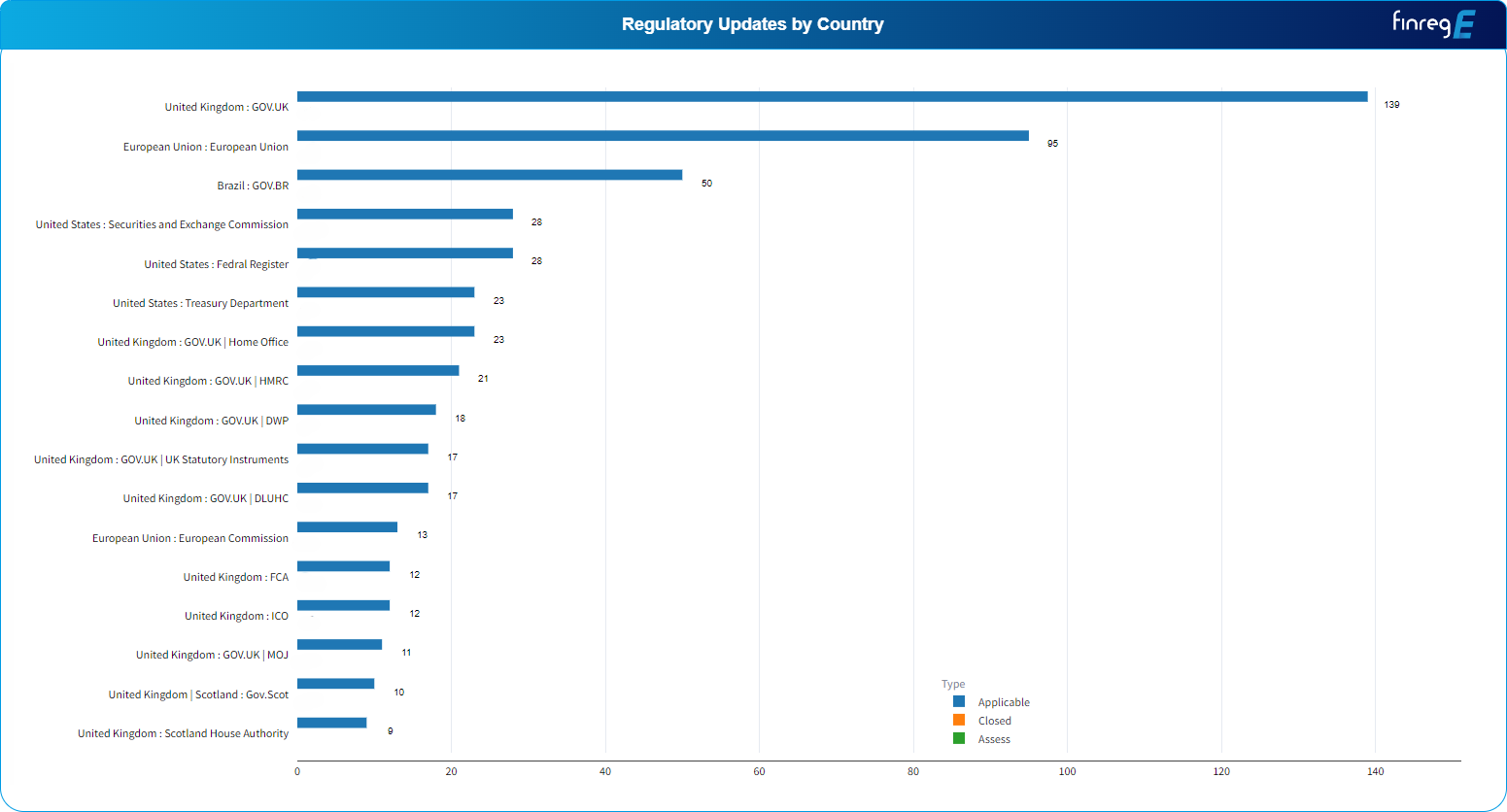

Leading regulatory horizon scanning, and intelligence tools offer capabilities like:

- Global coverage across 1000+ regulatory jurisdictions.

- Collection/analysis of content from regulatory agency sources.

- AI classification of documents into topics/categories.

- Regulatory inventory management functionality.

- Real-time alerts on regulatory changes.

- Dashboards to visualize upcoming regulations.

- Collaboration tools to discuss implications of regulatory changes.

These solutions enable compliance teams to efficiently monitor the evolving regulatory landscape and proactively adapt.

Building a Robust Regulatory Change Management Framework

Essentials of Regulatory Change Management

To harness the benefits of regulatory horizon scanning, organizations must establish a robust regulatory change management framework. This framework serves as the foundation for effectively identifying, evaluating, and implementing changes in response to evolving regulations. It includes processes, tools, and technologies that facilitate seamless regulatory compliance.

Components of an Effective Framework

- Regulatory Intelligence Software: Investing in cutting-edge regulatory intelligence software is essential. These tools use advanced algorithms and data analytics to monitor and interpret regulatory changes. They provide real-time updates, comprehensive analysis, and actionable insights, enabling organizations to make informed decisions.

- Regulatory Changes Tracking: A crucial aspect of the framework is the ability to track and document regulatory changes. This involves creating a centralized repository for all relevant regulations, updates, and associated documents. This ensures transparency and accountability in the compliance process.

- Regulatory Change Management Process Flow: Establishing a well-defined regulatory change management process flow ensures that the organization systematically identifies, assesses, and implements changes. This process flow should be adaptable to accommodate different types of regulations and their varying impacts on the business.

- Regulatory Change Management Requirements: Clearly defining the regulatory change management requirements is imperative. This includes understanding the scope of compliance, the responsibilities of different stakeholders, and the timelines for implementation. Clarity in requirements streamlines the compliance process and minimizes the risk of oversights.

Measuring and Adapting Compliance

Regulatory Change Management Process Flow

A best practice regulatory change management process flow enabled by predictive analytics includes:

- Horizon scanning data feeds surface new/updated regulations.

- Automated impact assessments conducted using AI/ML models.

- Risk ratings assigned to each regulatory change based on potential effect.

- Dashboards visualize upcoming regulations by risk, category, and timeline.

- Subject matter experts manually review automated assessments.

- Leadership evaluates regulatory risk levels against appetite thresholds.

- New regulations flowed into standard change management procedures.

- Effectiveness of change implementation quantified via identified metrics.

This process integrates predictive analytics to enable insightful, risk-based regulatory change management.

Meeting Regulatory Change Management Requirements

Utilizing predictive analytics and regulatory horizon scanning allows compliance functions to excel across several key regulatory change management requirements including:

- Risk-based approach – Focusing oversight on high-risk impending regulations.

- Evidence of effectiveness – Demonstrating successful change adoption quantitatively.

- Informed resource allocation – Optimizing investments based on analytical insights.

- Ongoing monitoring procedures – Sustaining effective tracking of regulatory developments.

This strengthens compliance program governance, oversight, and value delivery for the organization.

Adapting to Regulatory-Driven Change

To adapt to the continual change driven by the regulatory environment, leading compliance functions:

- Leverage agile principles to enable iterative, incremental evolution of controls.

- Utilize advanced analytics like AI/ML to automate aspects of regulatory change management.

- Implement flexible governance models optimized for speed and precision.

- Focus on enhancing organizational change management capabilities.

- Continually monitor leading indicators to refine regulatory change forecasts.

This approach develops the capacity to sustain compliance resilience amidst regulatory complexity and uncertainty.

Analysing and Addressing Regulatory Changes

Compliance leaders can leverage predictive analytics to strengthen analysis and responses to regulatory changes by:

- Estimating potential costs, risks, and benefits of regulatory proposals.

- Modelling and comparing the impacts of different implementation options.

- Monitoring enforcement trends to prioritize remediation initiatives.

- Analysing market reactions to model customer behaviour shifts.

- Conducting competitor analysis to inform strategic planning.

These analytical techniques lead to optimized, evidence-based decisions regarding regulatory change management.

FinregE: Your Automated Compliance Partner

FinregE, a leading provider of automated compliance software, empowers organizations to embrace the future of compliance. Their platform utilizes AI and ML to analyse regulatory data, predict changes, and automate compliance processes. This allows organizations to:

- Reduce compliance costs by automating manual tasks and streamlining workflows.

- Improve risk management by proactively identifying and mitigating regulatory risks.

- Gain a competitive advantage by demonstrating a commitment to proactive compliance.

Conclusion

The accelerating pace of regulatory change creates a pressing need for compliance functions to enhance preparedness and agility. By leveraging predictive analytics and regulatory horizon scanning, compliance teams can evolve into insightful, forward-looking business partners that enable strategic growth.

Realizing this future state requires focus across key dimensions:

- Implementing regulatory intelligence software and workflows to institutionalize horizon scanning.

- Incorporating advanced analytics into change management processes to enhance risk-based decisions.

- Automating compliance processes to increase bandwidth for value-add initiatives.

- Structuring an agile operating model to support iterative regulatory adaptation.

- Measuring effectiveness through data-driven compliance metrics.

By embracing predictive analytics and horizon scanning, compliance leaders can transform into proactive, digitally powered functions unlocking the organization’s potential amidst regulatory complexity.

Ready to take control of your compliance? Visit FinregE today and discover how their innovative solutions can help you embrace the future of compliance.