In the next few years, we can expect emerging risks to undermine operational stability and financial data security, prompting regulators to place stringent regulations on financial institutions.

To prepare for this reality, financial firms need to assess their approach to compliance and enrich their risk management framework with measurements that expose internal weaknesses to emerging risks.

In that regard, key risk factors (KRIs) are emerging as a critical component of managing risk. KRIs are vital because they expose risk concerning emerging trends, quantify their impact, provide risk alerts to key personnel in advance, and establish objectives within the risk management process.

In integrating KRIs into your risk management framework, you allow your compliance team to take a more proactive approach to security audits by identifying vulnerabilities against emerging threats and taking steps to rectify them.

Moreover, it helps you take a more proactive approach to financial compliance, converting it into a more agile and responsive function in a changing landscape.

Integrating KRIs into your risk management framework

Key risk indicators are metrics that predict the potential risk that can negatively impact your business, allowing you to quantify and monitor each risk. They function as change-related metrics and double as early-warning detection systems, helping you effectively monitor and mitigate risks—when formulated well, they highlight gaps in your processes.

KRIs are an integral part of compliance audits in a post-COVID-19 era because they bolster risk assessment plans by identifying where your business is vulnerable. In integrating them into risk management frameworks, compliance teams have two options: manual methods and automation.

Manual methods force teams to use spreadsheet applications to maintain, analyse and disseminate financial data. While this has been the predominant option for financial institutions, it is one plagued with several drawbacks.

Because it is dependent on manual input, it is susceptible to a variety of risks and errors; a minor lapse in judgment can ripple across the entire organisation and feed multiple teams with an inaccurate snapshot of risk.

Moreover, analysing KRIs to determine patterns is a time-consuming process; one that becomes a huge burden for compliance teams and makes it harder to manage compliance efficiently.

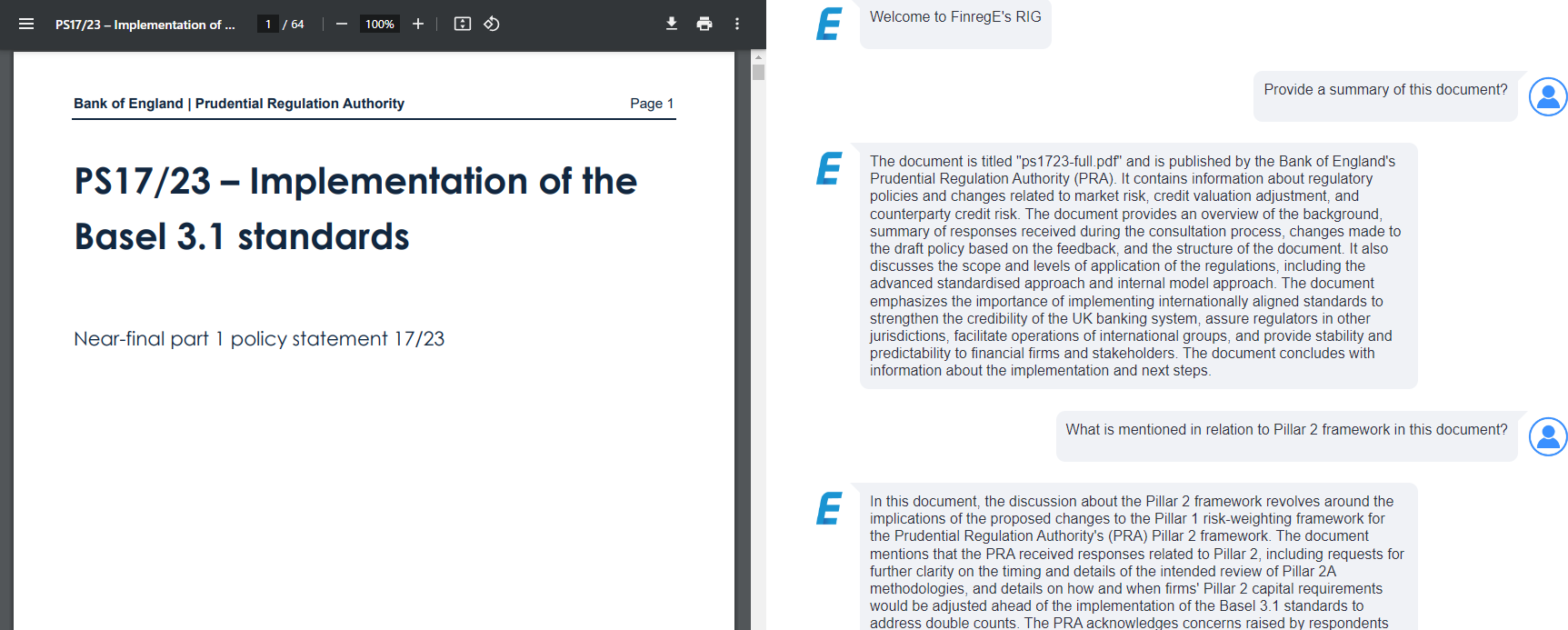

In contrast, automating this process can ensure that you assimilate KPIs into your risk management framework within a tighter schedule and consume fewer resources. From RegTech to risk prediction technologies, your compliance teams can leverage these solutions to track critical key indicators and cross-reference them with other sources of data for a richer, deeper analysis of current regulatory processes.

The metrics you choose can be imported automatically from reliable sources or parsed directly from official reports and papers, streamlining the risk management process. The key difference is simplicity; automated solutions can make the integration process far more efficient.

Today, most RegTech solutions leverage NLP, topic modelling, predictive analytics, and AI to convert risk management into a more manageable and efficient process. They also help teams assimilate key risk indicators into their risk management frameworks faster and more efficiently.

By leveraging automated solutions, you turn compliance into a more efficient, streamlined process that helps your compliance team determine if your business is at risk from emerging threats on a much faster timeline.

These insights allow you to take a more proactive approach to meet changing rules and regulations as well as mitigate potential risks.

Preparing for emerging risks by upgrading your risk management framework

As we enter a post-COVID-19-era, various disruptors, while not at the scale and magnitude of the global pandemic, will have the potential to interrupt the relative stability of the finance industry.

To account for these emerging threats, secure your data, and meet compliance requirements, KRIs need to be a critical part of your risk management framework.

By providing your team with deep insights into how your operations are vulnerable to emerging threats, you enrich your security auditing process to understand how these elements can compromise your functions and how to prepare for them.